yan7.site

Learn

Offers Contingent On Selling Home

The home sale contingency clause can be complicated to both structure and present to your buyer or seller. Contingent offers usually can't compete in a multiple offer situation but if the property isn't selling quickly it can be good for both buyer and seller. A home sale contingency clause. This happens when the buyer needs to sell his or her current home in order to have the money to buy a new home. You may be tempted to accept a contingency contract, which is a contract contingent on the successful sale of the buyers' current property. A buyer who is reliant on the funds from the sale of their current home to purchase a new one may opt to include a home sale contingency clause in their offer. A contingent offer essentially means that one of the conditions of buying the house is for it to pass an inspection or appraisal. If it doesn't pass those tests. A Home of Choice contingency allows you to sell your home to a buyer with the option to back out of the agreement and stay in your home if you're unable to find. If a listing is marked as contingent, it means that the sellers have accepted an offer and the property is now in escrow. During the initial period of an escrow. A home sale contingency is a clause you can add to an offer to protect you in case your current home doesn't sell. It states that you won't purchase the home. The home sale contingency clause can be complicated to both structure and present to your buyer or seller. Contingent offers usually can't compete in a multiple offer situation but if the property isn't selling quickly it can be good for both buyer and seller. A home sale contingency clause. This happens when the buyer needs to sell his or her current home in order to have the money to buy a new home. You may be tempted to accept a contingency contract, which is a contract contingent on the successful sale of the buyers' current property. A buyer who is reliant on the funds from the sale of their current home to purchase a new one may opt to include a home sale contingency clause in their offer. A contingent offer essentially means that one of the conditions of buying the house is for it to pass an inspection or appraisal. If it doesn't pass those tests. A Home of Choice contingency allows you to sell your home to a buyer with the option to back out of the agreement and stay in your home if you're unable to find. If a listing is marked as contingent, it means that the sellers have accepted an offer and the property is now in escrow. During the initial period of an escrow. A home sale contingency is a clause you can add to an offer to protect you in case your current home doesn't sell. It states that you won't purchase the home.

If a property is contingent, it means that the deal is not entirely complete yet and is technically still an active listing, so you may be able to view the. So contingent sales are simply when you, the buyer make an offer on a property, subject to them selling their home. In the contingency document, there is a. The sale of your new home is also contingent on the title being clear. The title company will do research and make sure that the property is true owned by the. When a property is marked as contingent, an offer has been accepted by the seller. Contingent deals are still active listings because they are liable to fall. A contingent offer on a house is an offer with a protective clause on behalf of the buyer. The contingency communicates that if the clause isn't met, the buyer. What types of home sales will accept a contingent offer? Mainly just standard sales. This is a sale where the sellers have equity in the home and they are. With a home sale contingency, your offer is contingent on the sale of your current home. You'll usually need to include a timeline, such as 30 to 60 days, in. This article will help you understand everything you need to know about making an offer contingent on the sale of your home in the Bay Area. A Contingent Home Sale is when a homeowner is selling their current home with a contingency of finding and closing escrow on a new home at the same time. Contingent means that an offer has been accepted to purchase the home, but the purchase is “contingent” on the sale of the buyers current home. A contingent offer is not unusual in real estate. Most offers have at least one contingency: The home sale won't go through until after the buyer orders a home. A sale and settlement contingency means the individual doesn't have an offer yet – but that they must sell and settle the house before he or she can purchase. If the sellers of your new home do agree to a contingent deal, they will typically have a clause in the contract that allows them to accept a non-contingent. The contingency clause gives a party to a contract the right to renegotiate or cancel the deal if specific circumstances turn out to be unsatisfactory. · An. In real estate, contingent means an offer has been accepted on a home, but before the sale can go through, certain criteria (specified in the contract) need to. If you're selling your home, setting contingencies protects you if something comes up with either buying another property or finding an acceptable offer from. A contingent listing means the seller has accepted an offer, but there are still conditions that need to be met for the sale to close. · Interested buyers can. A Contingent Home Sale is when a homeowner is selling their current home with a contingency of finding and closing escrow on a new home at the same time. House Sale Contingency. A buyer may include a contingency that the sale only goes through if the buyer can sell their existing home. A seller can include a.

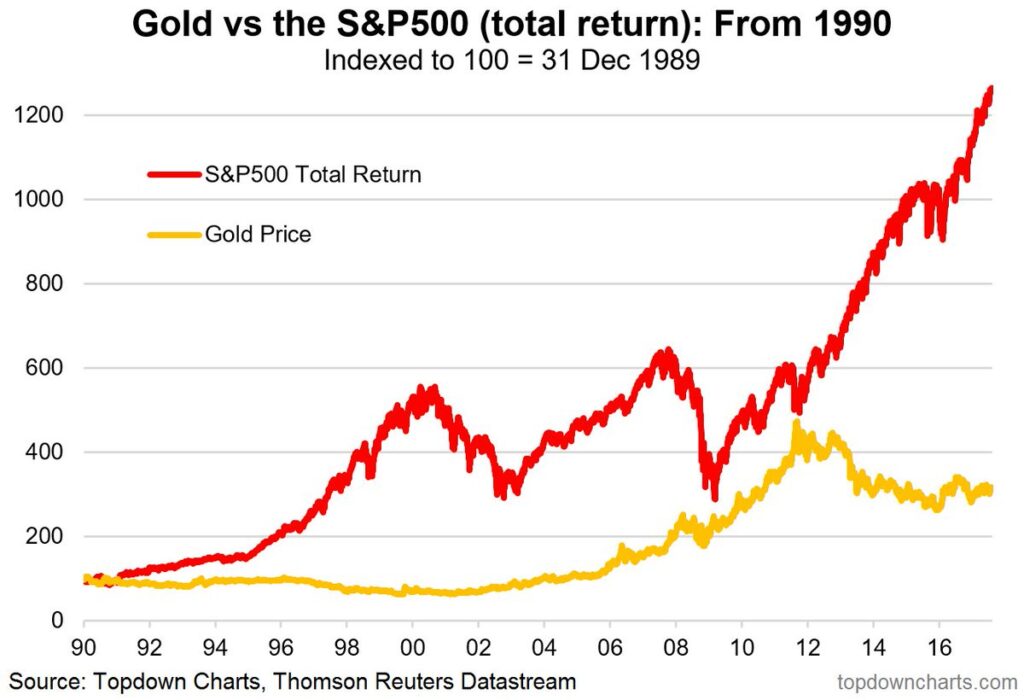

S&P 500 Long Term Return

What returns can you expect for the next ten years? · Very optimistic: 10% per year. · Optimistic: 6%-7% per year. · Base case: 4%-5% per year. · Pessimistic: %. The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's ® (S&P ®) for the 10 years ending. Why Is the S&P a Good Long-Term Investment? The S&P is one of the From to , the S&P yielded an annualized average return of %. Table of total yearly returns of the S&P (includes dividends) ; , ; , ; , ; , long term. SSGA will typically attempt to invest in the equity securities The Strategy's return may not match the return of the Index. Note: The. We remain highly optimistic on the general trend exhibited by long-term annualized returns. Standard & Poor's (S&P) Total Return Index. Total return means. Key Points. The S&P 's long-term, real compound growth rate with reinvested dividends is %. For example, in the last 25 years ( to ) the S&P has a simple average annual return of % and a geometric average annual return of. The S&P achieved an incredible % return a year, or per annum (p/a), one of its best runs when calculated over a decade. What returns can you expect for the next ten years? · Very optimistic: 10% per year. · Optimistic: 6%-7% per year. · Base case: 4%-5% per year. · Pessimistic: %. The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's ® (S&P ®) for the 10 years ending. Why Is the S&P a Good Long-Term Investment? The S&P is one of the From to , the S&P yielded an annualized average return of %. Table of total yearly returns of the S&P (includes dividends) ; , ; , ; , ; , long term. SSGA will typically attempt to invest in the equity securities The Strategy's return may not match the return of the Index. Note: The. We remain highly optimistic on the general trend exhibited by long-term annualized returns. Standard & Poor's (S&P) Total Return Index. Total return means. Key Points. The S&P 's long-term, real compound growth rate with reinvested dividends is %. For example, in the last 25 years ( to ) the S&P has a simple average annual return of % and a geometric average annual return of. The S&P achieved an incredible % return a year, or per annum (p/a), one of its best runs when calculated over a decade.

Stock market returns since If you invested $ in the S&P at the beginning of , you would have about $13,, at the end of , assuming. Annual Real Returns. Year, S&P (includes dividends), 3-month yan7.site, US T. Bond (year), Baa Corporate Bond, Real Estate, Gold*, S&P (includes. Returns for the S&P (–)1. Though the stock market's returns vary tremendously, the average returns for the S&P were positive in 76% of the. The S&P calculator below provides both the nominal and inflation-adjusted price and total return (assuming dividend reinvestment) of US stocks. So far in (YTD), the S&P index has returned an average %. Year, Return. , %. over the long term. Page 7. 20 Years of the S&P Equal Weight Index. June Research. 7. Equal Weight and the Distribution of Active Fund. Returns. It is. Over the last 65 years, the stock market has rewarded some investors with long-term growth. But for most investors, a realistic time horizon is 10 to 20 years—. Over the very long run, the stock market has had an inflation-adjusted annualized return rate of between six and seven percent. Another pattern: while. The S&P is regarded as a gauge of the large cap US equities market. The index includes leading companies in leading industries of the US economy. long-term, those big swings even out. The chart shows annual returns for the ten stock market sectors against the S&P The table below ranks the best to. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80%. S&P 1 Year Return is at %, compared to % last month and % last year. This is higher than the long term average of %. The S&P 1. Real returns. While inflation affects individual companies and industries differently, the S&P over the long term has historically provided positive real. Exhibit 1 shows calendar year returns for the S&P Index since The shaded band marks the historical average of 10%, plus or minus 2 percentage points. Over this period, the average annual return of the S&P has been 10%.2 The shaded band marks the historical average of 10%, plus or minus 2 percentage points. Charts illustrate positive versus negative periods in the S&P Index over the past 96 years. Source: S&P Index. Rather than trying to predict highs and. The total returns of the S&P index are listed by year. Total returns include two components: the return generated by dividends and the return generated by. The numbers clearly show that the Nasdaq has significantly outperformed S&P index in terms of return over long term despite witnessing higher. S&P Annual Total Return is at %, compared to % last year. This is higher than the long term average of %. The S&P Annual Total Return. Adjusted for inflation, the $1,, nominal end value of the original $ investment would have a real return of roughly $88, in dollars. This.

Best 15 Yr Refi Rates

Introduction to Year Fixed Mortgages ; 15 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %. Current year Fixed Rate Mortgage Rates · Rate changes: Never; fully fixed for entire term · Benefits: Stable payments; builds equity faster; lower total. The national average year fixed refinance interest rate is %, down compared to last week's of %. Additionally, the current national average year fixed mortgage rate decreased 1 basis point from % to %. The current national average 5-year ARM. With today's low rates, though, more people than ever can afford to take advantage of the benefits that a year mortgage brings. Current 15 year refi rates. Mortgage - Refinance|Descr=15 Year Fixed Rate|ProductAttribute=PAYMENT_STREAM_URL# Two great ways to refinance. Whatever your mortgage refinancing needs. Average Mortgage Rates, Daily ; 15 Year Refinance. %. % ; 5 Year ARM. %. % ; 3 Year ARM. %. % ; Jumbo. %. %. The current average year fixed refinance rate decreased 4 basis points to %. For context, the national average year fixed refinance rate was 3 basis. Find out how to get the best year mortgage rate for your needs, and whether a or year mortgage is right for you. Introduction to Year Fixed Mortgages ; 15 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %. Current year Fixed Rate Mortgage Rates · Rate changes: Never; fully fixed for entire term · Benefits: Stable payments; builds equity faster; lower total. The national average year fixed refinance interest rate is %, down compared to last week's of %. Additionally, the current national average year fixed mortgage rate decreased 1 basis point from % to %. The current national average 5-year ARM. With today's low rates, though, more people than ever can afford to take advantage of the benefits that a year mortgage brings. Current 15 year refi rates. Mortgage - Refinance|Descr=15 Year Fixed Rate|ProductAttribute=PAYMENT_STREAM_URL# Two great ways to refinance. Whatever your mortgage refinancing needs. Average Mortgage Rates, Daily ; 15 Year Refinance. %. % ; 5 Year ARM. %. % ; 3 Year ARM. %. % ; Jumbo. %. %. The current average year fixed refinance rate decreased 4 basis points to %. For context, the national average year fixed refinance rate was 3 basis. Find out how to get the best year mortgage rate for your needs, and whether a or year mortgage is right for you.

year mortgage: %. Average refinance rates today: year refinance: %; year refinance: %. Find the best mortgage. Today's Mortgage Refinance Rates ; FHA Year Fixed, %, % ; Year Fixed, %, % ; 7/6 ARM, %, % ; 5/6 ARM, %, %. Average Mortgage Rates, Daily ; 15 Year Refinance. %. % ; 5 Year ARM. %. % ; 3 Year ARM. %. % ; Jumbo. %. %. Rate IL - Chicago - assists you with low cost home purchase and refinance mortgages, great service, and fast closings. Compare year mortgage rates when you refinance your loan. Save money by comparing current year mortgage rates from NerdWallet. "Best rate by far Fewest hoops to If you want to be mortgage-free faster and pay less interest, you could change your year loan term to a year. about Year Fixed (Refinance)Today's Rate. Year Fixed (Mini Mortgage) To get the best mortgage refinance rate: Improve your credit score. Lenders that offer year mortgage refinance rates ; Better. % ; Discover. % ; SoFi. % ; Chase. %. Year Fixed Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. At the time they refinance, current rates for a year mortgage are at %, while year fixed rates are averaging %. Here's how their refinance options. Today. The average APR for the benchmark year fixed-rate mortgage fell to %. Last week. %. year. Better: NMLS# Better · Great for digital convenience · % · 5% ; Central Bank: NMLS# Central Bank · % · % ; NBKC: NMLS# NBKC · Great. Today's Mortgage Refinance Rates ; FHA Year Fixed, %, % ; Year Fixed, %, % ; 7/6 ARM, %, % ; 5/6 ARM, %, %. Shorter terms. Another reason is to shorten the terms of your mortgage. This could mean moving from a year to a year mortgage, for. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. year fixed-rate mortgage: %. Rates likely won't go down significantly until the Federal Reserve begins to make cuts. Channel doesn't expect this to. Compare mortgage rates when you buy a home or refinance your loan. Save year fixed rate:APR %. +%. Today. %. Over 1y. 5-year ARM rate. Today's competitive refinance rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · Year FixedAdjustable-Rate MortgageBorrowSmart AccessFHA LoanHomeReady Year Mortgage Rates: A Complete Guide. Read The Article A middle-aged.

Youth Stock Trading Account

1. College Savings Plan · 2. Coverdell Education Savings Account · 3. Brokerage account · 4. UGMA/ UTMA accounts · 5. Custodial Roth IRA. Cryptocurrency markets and exchanges are not regulated with the same controls and protections as equity trading. UNest Crypto accounts are not UTMA/UGMA's. They. The Schwab One® Custodial Account is a brokerage account that allows you to make a financial gift to a minor and help teach them about investing. It is set up. Investing early on a child's behalf helps M1 Finance, LLC does not charge commission, trading, or management fees for self-directed brokerage accounts. Savings Accounts. If you have money in a savings account, you receive interest on the account balance, and you can easily get your money whenever you want it. Key Takeaways: A custodial investment account for minors is established by an adult for a child. Its a type of savings or brokerage account managed by the adult. Open an E*TRADE custodial account - a brokerage account that a child can take over at 18 or It is a great way to protect and build a child's future. With a custodial account (aka Kids Portfolio at Stash), you can buy stocks and ETFs on behalf of the children in your life—and the money is theirs when they. A Roth IRA for Kids provides all the benefits of a regular Roth IRA, but is geared toward children under the age of Minors cannot generally. 1. College Savings Plan · 2. Coverdell Education Savings Account · 3. Brokerage account · 4. UGMA/ UTMA accounts · 5. Custodial Roth IRA. Cryptocurrency markets and exchanges are not regulated with the same controls and protections as equity trading. UNest Crypto accounts are not UTMA/UGMA's. They. The Schwab One® Custodial Account is a brokerage account that allows you to make a financial gift to a minor and help teach them about investing. It is set up. Investing early on a child's behalf helps M1 Finance, LLC does not charge commission, trading, or management fees for self-directed brokerage accounts. Savings Accounts. If you have money in a savings account, you receive interest on the account balance, and you can easily get your money whenever you want it. Key Takeaways: A custodial investment account for minors is established by an adult for a child. Its a type of savings or brokerage account managed by the adult. Open an E*TRADE custodial account - a brokerage account that a child can take over at 18 or It is a great way to protect and build a child's future. With a custodial account (aka Kids Portfolio at Stash), you can buy stocks and ETFs on behalf of the children in your life—and the money is theirs when they. A Roth IRA for Kids provides all the benefits of a regular Roth IRA, but is geared toward children under the age of Minors cannot generally.

Account Options · Retirement Accounts · Brokerage Account Options · Plans · Cash and Credit · Investment Products · Stock Selection · Bonds, CDs and other. Account Options · Retirement Accounts · Brokerage Account Options · Plans · Cash and Credit · Investment Products · Stock Selection · Bonds, CDs and other. You can hold mutual funds, ETFs (exchange-traded funds), stocks, bonds, and more, which can generate returns and help you grow your savings. Use it to save for. Coverdell education savings accounts A Coverdell education savings account (ESA) is similar to a plan in that it's designed to help save and pay for not. 1. Custodial Roth IRA · 2. Education Savings Plans · 3. Coverdell Education Savings Accounts · 4. UGMA/UTMA Custodial Accounts · 5. Brokerage Account. If underage, options include opening a custodial account with parents or a state-sponsored investment account under the guidance of a parent or legal guardian. platform and financial literacy curriculum for Kth students. We are devoted to financial inclusion by teaching holistic finance and investing to our youth. Investing for teens has become popular through lots of new engaging apps that allow teens to easily trade stocks through custodial brokerage accounts. These. See our "Stock Exercise" below. Parents: You can help your children learn You have $ in your bank account, you deposit another $ each year. One way to teach teenagers under the age of 18 about investing and saving is to open a custodial account in their name. "Taking Stock in Teen Trading" U.S. Types of Brokerage Accounts for Your Kids · college savings account. If you're investing for a child's education, you might use a state-specific account. Teenagers younger than 18 cannot set up their own account to invest in the stock market, but they can get an adult to do it on their behalf. What Is the Stock. Your kids must be at least 18 years old before they can open a brokerage account of their very own. But parents can open an account on their behalf. Opening a. Discover your investment choices. Find your preferred way to invest, whether you're interested in simple stock trades, mutual funds, ETFs or fixed income and. Another reason to choose BusyKid · Our revolutionary investment platform allows parents to help teach children of all ages about investing in the stock market. Coverdell education savings accounts A Coverdell education savings account (ESA) is similar to a plan in that it's designed to help save and pay for not. To buy a stock, you need to first add money to your brokerage account (by Certain brokerages like Fidelity also offer specialized Youth Accounts. Youth · Students · Competitions and Awards · Tools Test your knowledge of day trading, margin accounts, crypto assets, and more! Taking Stock in Teen Trading. Greenlight's investing app for kids teaches money management and investing fundamentals – with real money, real stocks and real-life lessons. Introducing Fidelity Youth®—a free* app that helps teens save and invest their own money. Teens can practice good money habits with features that help them.

Bts Concert Ticket Cost

BTS Bangtan Boys Commemorative Ticket Stub for SOFI Stadium 11/27 concert. $ $ shipping. 9 watching. BTS PERMISSION TO DANCE ON STAGE - LA CONCERT Nov , Dec SoFi Stadium ticket prices and fees Without fees: $, $, $, $ Typically, BTS tickets can be found for as low as $, with an average price of $ Hpe my answer is helpful for you. Please don't. The Perfect MIC Drop Show! ; 28, Concert Ticket −5 ; 28, Concert Ticket −5 · Power. 8, That depends on the the concert and the event. Typical concert tickets for BTS sell for about , KRW ~ , KRW. That's from the. Ticket Categories · Fan Club tickets (FC tickets) – Original price: 11, yen · Stage Site Fan Club tickets – Original price: 11, yen · Regular tickets –. How much do BTS tickets cost? The average ticket price to see BTS in concert is $, but you can get tickets starting at just $! Right now, the cheapest price for BTS tickets is $N/A, with an average price of $N/A. BTS ticket prices will fluctuate based on many factors such as inventory. Seat Geek, another secondary market, appears to be selling tickets for all four show dates ranging from $ to over $7, for each ticket. Ticketmaster. BTS Bangtan Boys Commemorative Ticket Stub for SOFI Stadium 11/27 concert. $ $ shipping. 9 watching. BTS PERMISSION TO DANCE ON STAGE - LA CONCERT Nov , Dec SoFi Stadium ticket prices and fees Without fees: $, $, $, $ Typically, BTS tickets can be found for as low as $, with an average price of $ Hpe my answer is helpful for you. Please don't. The Perfect MIC Drop Show! ; 28, Concert Ticket −5 ; 28, Concert Ticket −5 · Power. 8, That depends on the the concert and the event. Typical concert tickets for BTS sell for about , KRW ~ , KRW. That's from the. Ticket Categories · Fan Club tickets (FC tickets) – Original price: 11, yen · Stage Site Fan Club tickets – Original price: 11, yen · Regular tickets –. How much do BTS tickets cost? The average ticket price to see BTS in concert is $, but you can get tickets starting at just $! Right now, the cheapest price for BTS tickets is $N/A, with an average price of $N/A. BTS ticket prices will fluctuate based on many factors such as inventory. Seat Geek, another secondary market, appears to be selling tickets for all four show dates ranging from $ to over $7, for each ticket. Ticketmaster.

Seat Geek, another secondary market, appears to be selling tickets for all four show dates ranging from $ to over $7, for each ticket. Ticketmaster. BTS Concert Tickets - Tour Dates. BTS. 1,, fans. I'm a fan. Off tour Maybe not worth the price we had to pay for the tickets. Next time. How much do tickets cost? Prices vary depending on seat location and availability. Is there a ticket limit? Yes, there's usually a limit on the number of. In the US, $ VIP, $ others. That adjusted pricing will still make it cost between an arm to the cost of 2 arms. Find the best prices on BTS tickets on SeatGeek. Discover BTS concerts, schedule, venues and more. Tickets protected by Buyer Guarantee. The ticket price ranged from $60 to $ While $60 sounds a bit affordable, these seats were located at the very back of the stadium (ie the last ones). BTS World Tour: Love Yourself, commonly known as the Love Yourself World Tour, was the third worldwide concert tour headlined by South Korean band BTS to. Prices at SeatPick are very competitive and the current average price for BTS tickets starts from Wherever BTS performances take place, and to whatever. VIP ticket holders will need their digital ticket as well as the ticket purchasers ID in order to check in for your package on the day of your concert. For. Went to the BTS concert. The pre reserved Parking worked super and effective. We had the BTS tickets with the Stade france experience for EUR. each ticket. Buy BTS tickets from the official yan7.site site. Find BTS tour schedule, concert details, reviews and photos. VIP Ticket Prices ; VIP Soundcheck Package. Price from $ Exclusive Access To The Preshow VIP Soundcheck With Bts; Premium Reserved Seating in The First BTS PERMISSION TO DANCE ON STAGE - LA CONCERT Nov , Dec SoFi Stadium ticket prices and fees PRICES: $, $, $, $, $, $, $, $75, $ To find the prices for BTS tickets, check our ticket sales section above to BTS concert tickets. How to buy BTS tickets? Here is a simple four-step. Supply: Prices of resources Ticket Sales Decrease due to the Global Pandemic Venue Shutdown There is a decrease in ticket sales because all the venues in. BTS New York tickets. Utilize the pricing filters like “best seats” and “quantity” to populate the exact list of tickets you're looking for. Click the heart. How much do tickets cost? Prices vary depending on seat location and availability. Is there a ticket limit? Yes, there's usually a limit on the number of. Supply: Prices of resources Ticket Sales Decrease due to the Global Pandemic Venue Shutdown There is a decrease in ticket sales because all the venues in. How much are BTS tickets? Regardless of your budget, GoodDeedSeats has ticket prices that are right for you. Prices can vary depending on the location, venue. Weeks prior, Bighit had announced that concert goers could enter a raffle to win tickets to the BTS STUDIO experience. The cost alone boggles the mind.

Maximum Life Insurance

Terms of one, five, 10 or 20 years or up to the age of 65 are available. This type of policy only pays a benefit if you die during the policy term. Term. How does term life insurance differ from permanent life insurance? policy will automatically renew for another term period subject to a maximum age limit. In Missouri, the maximum limit for a death benefit of life insurance policies is $,, while the cash value limit is $, For example, if you have. It depends on their age. Insurance companies seta maximum age limit for term life insurance policies. This is usually 80 to 90 years old, but may be higher or. The short answer is yes. You can have more than one life insurance policy, and you don't have to get them from the same company. Children's rider provides term life insurance for your children. Most companies require the child to be at least 14 days old. Coverage typically lasts until the. The short answer is yes. You can have more than one life insurance policy, and you don't have to get them from the same company. The maximum benefit payable is $, Business Travel Accident Insurance. Should a faculty or staff member die as a result of an accident while on authorized. Explore life insurance options to find the perfect fit for you and your family. Get quotes, ask questions, & secure your future. Terms of one, five, 10 or 20 years or up to the age of 65 are available. This type of policy only pays a benefit if you die during the policy term. Term. How does term life insurance differ from permanent life insurance? policy will automatically renew for another term period subject to a maximum age limit. In Missouri, the maximum limit for a death benefit of life insurance policies is $,, while the cash value limit is $, For example, if you have. It depends on their age. Insurance companies seta maximum age limit for term life insurance policies. This is usually 80 to 90 years old, but may be higher or. The short answer is yes. You can have more than one life insurance policy, and you don't have to get them from the same company. Children's rider provides term life insurance for your children. Most companies require the child to be at least 14 days old. Coverage typically lasts until the. The short answer is yes. You can have more than one life insurance policy, and you don't have to get them from the same company. The maximum benefit payable is $, Business Travel Accident Insurance. Should a faculty or staff member die as a result of an accident while on authorized. Explore life insurance options to find the perfect fit for you and your family. Get quotes, ask questions, & secure your future.

With a Primerica term life insurance policy, you're covered until age 95 and your policy remains in effect as long as you keep your premiums current. HOW MUCH. Some insurance experts suggest that you purchase five to eight times your current income. However, it is better to go through the above questions to figure a. Some insurance experts suggest that you purchase five to eight times your current income. However, it is better to go through the above questions to figure a. The maximum face amount of a USGLI policy is $10, All USGLI policies were declared paid-up as of January 1, meaning that no further premium payments. Insurability limits vary by age and by insurer, but generally range from 15 – 35 times annual income. Note that insurability limits apply to the total amount of. Consider a life insurance term length of at least 30 years. If your spouse is your designated beneficiary, they would receive the death benefit if you pass away. Nationwide's term life products · 10, 15, 20, 30 years (exclusions may apply depending on applicant age) · No maximum death benefit, as long as it's reasonable. Instant Answer Term Insurance provides $50, of death benefit protection until age 50 or a maximum 10 years, whichever is longer. This coverage is designed to. If you stop paying premiums, the insurance stops. Term policies pay benefits if you die during the period covered by the policy, but they do not build cash. Whole life insurance is designed to provide protection for dependents while building cash value. The policy pays a death benefit if the insured person dies. A term life insurance policy is the simplest, purest form of life insurance: You pay a premium for a period of time – typically between 10 and 30 years. - The SGLI maximum coverage amount will increase from $, to $, effective March 1, , due to Public Law , signed by the President on Oct. Will my premiums stay the same or increase each year? · Term 80 is our longest coverage term that lasts until age · Term 10 is our most affordable coverage. You can have multiple life insurance policies if you wish – there is no legal limit. But remember, if you find your situation changes in the future it's. According to the IRS Premium Table, the cost per thousand is The employer pays the full cost of the insurance. If at least one employee is charged more. Coverage limits: Term life policies offer coverage starting at $25, with the upper limit depending on the policy and underwriting. For whole life policies. Will my premiums stay the same or increase each year? · Term 80 is our longest coverage term that lasts until age · Term 10 is our most affordable coverage. Whole Life Insurance: · You receive coverage your entire lifetime. · Premiums are typically higher, maximizing your payout long-term. · The death benefit is. As people age, they often benefit from a term life insurance policy that is in effect until they hit retirement. For instance, instead of purchasing a year. Graph showing how term life insurance needs change over time. The peak coverage years are. Term life insurance is important — but it doesn't have to be.

Do You Need Qualifications To Be A Financial Advisor

If you want to become a financial planner, you'll need a mandatory license and optional degrees or certifications before getting a job in the field. Earn your. A bachelor's degree in finance, accounting, economics, business, or mathematics could be a good first step to a financial career. Those looking to become a. What skills and certifications are required for financial advisors? · Bachelor's degree or equivalent work-related experience with a track record of success. Fully qualified financial advisors have taken the Certified Financial Planner exam. If they plan to sell stocks, mutual funds, or bonds, they will have to pass. I WANT TO BECOME A FINANCIAL ADVISOR. WHICH QUALIFICATIONS DO I NEED? · yan7.site or equivalent NQF level 8 qualification · RE5 certification · Post-graduate Diploma. While a background in finance can be advantageous, it is not a strict requirement. Many financial advisory firms value diverse perspectives and skills that. You don't need a degree you just need a high-school diploma. All you need is a life and health insurance license, and to pass the series 6 or 7. To become a financial adviser, and before providing advice, individuals will need to pass a Level 4 qualification in financial advice recognised by the FCA. Step #1: Start with the SIE Exam The Securities Industry Essentials (SIE) Exam is a co-requisite to the Series 7 exam, but you don't need a sponsor to take it. If you want to become a financial planner, you'll need a mandatory license and optional degrees or certifications before getting a job in the field. Earn your. A bachelor's degree in finance, accounting, economics, business, or mathematics could be a good first step to a financial career. Those looking to become a. What skills and certifications are required for financial advisors? · Bachelor's degree or equivalent work-related experience with a track record of success. Fully qualified financial advisors have taken the Certified Financial Planner exam. If they plan to sell stocks, mutual funds, or bonds, they will have to pass. I WANT TO BECOME A FINANCIAL ADVISOR. WHICH QUALIFICATIONS DO I NEED? · yan7.site or equivalent NQF level 8 qualification · RE5 certification · Post-graduate Diploma. While a background in finance can be advantageous, it is not a strict requirement. Many financial advisory firms value diverse perspectives and skills that. You don't need a degree you just need a high-school diploma. All you need is a life and health insurance license, and to pass the series 6 or 7. To become a financial adviser, and before providing advice, individuals will need to pass a Level 4 qualification in financial advice recognised by the FCA. Step #1: Start with the SIE Exam The Securities Industry Essentials (SIE) Exam is a co-requisite to the Series 7 exam, but you don't need a sponsor to take it.

A bachelor's degree is required for a career as a financial advisor. Majors in finance, economics, business, statistics or similar fields are acceptable. Every financial advisor must earn at least a bachelor's degree, whether it be in finance, accounting, or business. Those seeking higher credentials will want to. The FAA Program prepares you to become a Financial Advisor through intensive training. Our extensive curriculum provides you state-of-the-art financial tools. To become an entry-level financial planner, you need to have several qualifications, including a bachelor's degree and certification or licensure, which is. A CFP is only possible if you have a bachelors. Upvote. If you want to qualify to sit for the CFP exam, you must fulfill all requirements laid out by the CFP Board. You must have a bachelor's degree, have worked as a. Should You Become A Financial Advisor? · You have a strong ability to influence others to keep your clients rational · Your selling skills are above average - you. The two-part education requirement includes both (1) completing coursework on financial planning through a CFP Board Registered Program, and (2) holding a. There is no one way to become a financial advisor, but most have at least a bachelor's degree. Prospective financial advisors might pursue degrees in business. A number of undergraduate degree programs can prepare you to start a career as a financial advisor. You can choose to major in business, finance, accounting or. What background and experience do I need to be hired as a financial advisor with Edward Jones? · Bachelor's degree or equivalent work-related experience with a. Bachelor's Degrees for Financial Planners. A bachelor's degree is the minimum entry-level requirement for most financial planning jobs. These four-year programs. Bachelor's Degrees for Financial Planners. That means, in almost every case, at least a four-year bachelor's degree. The most popular majors for anyone heading. They will first need to earn a bachelor's degree in accounting, business management, finance or a closely related field. Applicants looking to further enhance. There are two main parts to the requirement: completion of CFP Board-approved coursework, and a bachelor's degree in any discipline from an accredited college. How Can I Become a Financial Advisor? A bachelor's degree is the standard educational requirement to become a financial advisor, according to the U.S. Bureau. First, you should obtain a bachelor's degree in a relevant field such as finance, economics, or business. This educational background will provide you with the. A bachelor's degree is typically required for personal financial advisors. Employers do not necessarily require a particular field of study when it comes to. Obtain a bachelor's degree: Many financial advisors have a Bachelor's Degree in Finance, Economics, Accounting, or a related field. It's not a requirement, but. The FAA Program prepares you to become a Financial Advisor through intensive training. Our extensive curriculum provides you state-of-the-art financial tools.

Truist Home Equity Loan Interest Rate

A home equity line of credit lets you tap into the equity in your home and Generally, you can choose to draw at a variable or fixed interest rate—whichever. The rate will never exceed 18% APR, or applicable state law, or below % APR. Choosing an interest-only repayment may cause your monthly payment to increase. Simply put, home equity means your property is worth more than you owe on it. Brian Ford, Head of Financial Wellness at Truist, calls home equity the “magic. Actual APR will be determined by member's credit score at the time of the loan request. Rate subject to change. This product has a variable rate that is based. SunTrust does not appear to offer home equity loans. But the company does offer home equity lines of credit (HELOCs). As opposed to a home equity loan (which is. % APR for 6 months then % to % variable APR. Variable rates that follow the market. No bank fees at closing and no annual usage or early. Interest rate range – % to % APR at time of writing; Minimum credit score – Unspecified. Truist urges borrowers to keep their “credit score above ”. Loan payment example: on a $50, loan for months at % interest rate, monthly payments would be $ Payment example does not include amounts for. CNET staff -- not advertisers, partners or business interests -- determine how we review the products and services we cover. If you buy through our links. A home equity line of credit lets you tap into the equity in your home and Generally, you can choose to draw at a variable or fixed interest rate—whichever. The rate will never exceed 18% APR, or applicable state law, or below % APR. Choosing an interest-only repayment may cause your monthly payment to increase. Simply put, home equity means your property is worth more than you owe on it. Brian Ford, Head of Financial Wellness at Truist, calls home equity the “magic. Actual APR will be determined by member's credit score at the time of the loan request. Rate subject to change. This product has a variable rate that is based. SunTrust does not appear to offer home equity loans. But the company does offer home equity lines of credit (HELOCs). As opposed to a home equity loan (which is. % APR for 6 months then % to % variable APR. Variable rates that follow the market. No bank fees at closing and no annual usage or early. Interest rate range – % to % APR at time of writing; Minimum credit score – Unspecified. Truist urges borrowers to keep their “credit score above ”. Loan payment example: on a $50, loan for months at % interest rate, monthly payments would be $ Payment example does not include amounts for. CNET staff -- not advertisers, partners or business interests -- determine how we review the products and services we cover. If you buy through our links.

Shop for the best home equity line of credit interest rates by comparing offers from multiple HELOC lenders. At a % interest rate, the APR would be %. The monthly payment schedule would be payments of $ and 1 payment of $ The payment amount. Interest Type: Adjustable ; Term: 30 Years ; Interest Rate: % ; Rate change (per year): %. Key benefits · Competitive, variable interest rate. Rates from Prime +% to Prime +% APR. · Expect fast decisions and same-day funding may be available. Current mortgage rates ; Year Fixed · % · % APR ; Year Fixed · % · % APR ; Year Jumbo · 7% · % APR ; Year FHA · % · % APR ; credit score: The minimum credit score required for a U.S. Bank HELOC is Best for low introductory rates. Connexus Credit Union. The rate will never exceed 18% APR, or applicable state law, or below % APR. Choosing an interest-only repayment may cause your monthly payment to increase. Tap into your home equity without a loan, monthly payments or interest charges, ever; Avoid the rate volatility of a HELOC; Minimum Credit Score. Next. Is Truist Bank Home Equity Loans right for you? These reviews can help you decide. Discover its key features and pros & cons before you make up your mind. Mortgage Rates and APR examples are representative of products available through Truist Bank. In addition to discount points provided, the APR also includes an. You'll still have the ease of just one monthly mortgage payment. Thereare closing costs, but you may be able to roll them into the loan.1 If interest rates have. Additionally, even though I had never been late on my car loan, HELOC or mortgage payment with them, they raised my interest rate on my HELOC THREE times in a. The third recommended alternative is using a credit card, which can be great for borrowing modest sums over a few months. However, SunTrust/Truist's published. APR is based on the highest Prime Rate published in the Money Rates table of The Wall Street Journal on the last business day of the previous calendar month. % APR* introductory rate. Open the door to cash, when you need it. Our Home Equity Line of Credit gives you the flexibility to borrow against the equity in. The APR for a traditional second mortgage loan takes into account the interest rate charged plus points and other finance charges. ▫ The APR for a home equity. Enjoy competitive rates that are typically lower than many other forms of credit, flexible payment options, and tax deductible interest if your home equity. *AutoPay discount is only available prior to loan funding. Rates without AutoPay are % points higher. Excellent credit required for lowest rate. Rates range. Please call () , email us, or find a loan officer serving your community to learn more about a specific APR for your transaction. Monthly payments. Truist Bank has two savings accounts and one money market account, none of which offer competitive yields. Truist's two savings accounts earn a % APY.

Top Travel Medical Insurance

Compare & Buy Travel Insurance · AAA · AIG · Allianz · AXA Assistance USA · Battleface · Berkshire Hathaway · Cat 70 · Faye. AARDY is the world's leading Travel Insurance Marketplace. We always recommend that a traveler consider travel insurance. For international travel we consider. Squaremouth helps travelers quote, compare, and buy travel insurance. We help every customer to find the best trip insurance for the lowest price. Allianz · Travelex · Travel Guard · Travel Insured International. You can compare insurance policies and costs among various providers at SquareMouth and at. Safe Travels USA from Trawick is the best plan option for international citizens visiting the United States and other countries. In addition to those listed. Get a quote, compare plans and buy Allianz travel insurance online. Trip protection for cancellations, emergency medical & more. Over 70M policies sold. Compare Travel Insurance Plans from Our Trusted Providers · AIG Travel · AXA Assistance USA · Berkshire Hathaway Travel Protection · Crum & Forster - Travel Insured. If you're looking for stand-alone medical travel insurance, some of the top providers include IMG, Seven Corners, Atlas Travel Insurance and GeoBlue. There are. Explore our top SafeTrip plans for travelers. Our travel protection plans Travel medical insurance plans typically cover emergency medical and dental costs. Compare & Buy Travel Insurance · AAA · AIG · Allianz · AXA Assistance USA · Battleface · Berkshire Hathaway · Cat 70 · Faye. AARDY is the world's leading Travel Insurance Marketplace. We always recommend that a traveler consider travel insurance. For international travel we consider. Squaremouth helps travelers quote, compare, and buy travel insurance. We help every customer to find the best trip insurance for the lowest price. Allianz · Travelex · Travel Guard · Travel Insured International. You can compare insurance policies and costs among various providers at SquareMouth and at. Safe Travels USA from Trawick is the best plan option for international citizens visiting the United States and other countries. In addition to those listed. Get a quote, compare plans and buy Allianz travel insurance online. Trip protection for cancellations, emergency medical & more. Over 70M policies sold. Compare Travel Insurance Plans from Our Trusted Providers · AIG Travel · AXA Assistance USA · Berkshire Hathaway Travel Protection · Crum & Forster - Travel Insured. If you're looking for stand-alone medical travel insurance, some of the top providers include IMG, Seven Corners, Atlas Travel Insurance and GeoBlue. There are. Explore our top SafeTrip plans for travelers. Our travel protection plans Travel medical insurance plans typically cover emergency medical and dental costs.

The top 10 international medical insurance companies offering global health insurance for foreigners & international citizens. VisitorsCoverage offers US visitor insurance, international travel medical insurance, trip insurance, and more. Compare travel insurance plans and buy. Insubuy has been a leader in international medical insurance coverage since the year We've matched hundreds of thousands of travelers with the perfect. Travel medical insurance (also known as travel health insurance) is part of a trip insurance package, and it is very similar to the health insurance coverage. Our research shows the best international travel medical insurance plans come from Tin Leg, Nationwide, Faye, & IMG offering up to $2M of coverage. like. Trawick International travel insurance. Trawick International offers visitor medical insurance for coronavirus with their Safe Travels USA Insurance. The Safe. How to buy travel medical insurance. The best overall plan for travel medical insurance is Travel Medical from Seven Corners. This plan has the option for Covid. Without travel medical insurance, you'll be handling these unexpected expenses on your own. At best, that could put a dent in your vacation budget, and at worst. AIG Travel was awarded top honors by Forbes Advisor in their Best Travel Insurance providers list for consumers. Out of 15 travel insurance companies ranked by. Best Travel Insurance Companies · 1. WorldTrips · 2. Allianz · 3. IMG Global · 4. Seven Corners · 5. GeoBlue · 6. Trawick International. Best for Medical Coverage: GeoBlue. Best for trip delay · Faye ; Best for lost baggage: AXA Assistance USA ; Best for families: Travel Guard ; Best for · American Express ; Best for trip · Allianz Travel. Compare travel insurance policies from America's top providers. Read in Travel Medical Insurance · Medical Evacuation Insurance · Pregnancy Travel. With SafeTrip travel protection plans from UnitedHealthcare Global, you can set off on your next adventure prepared and ready for what comes your way. Seven Corners · Trawick International · Tin Leg. View a full breakdown of the top travel medical insurance providers. And, together with Medipac Assist, Medipac has the necessary medical resources to properly support our clients during a medical emergency while travelling. WorldTrips Atlas International · ratings ; GeoBlue Voyager Choice · ratings ; International Medical Group Patriot International Lite · ratings ; GeoBlue. USI Travel Insurance Services Ranked as one of the Best Travel Insurance Companies by Forbes Advisor For the fifth year in a row, USI Travel Insurance. Top Considerations. Cost of travel insurance: Travel insurance usually Travel medical insurance provides short-term medical coverage. Emergency.

Special Mortgage Loans For Nurses

Types of Mortgage Loans Available for Nurses · FHA Loans: The Federal Housing Administration (FHA) offers loans with lower down payments and more lenient credit. Fidelity Home Groups Heroes Program is designed to provide down payment assistance in the form of a grant equal to a minimum of 2% of the purchase price for. Official website of the Nurse Next Door Program. Grants, down payment assistance, home loans and other special programs for nurses and healthcare workers. Eligible occupations in underserved communities are: Nursing (including licensed practical nursing, nurse practitioners, registered psychiatric nurses and. A home loan program to help medical professionals, including residents, doctors, nurse practitioners and more fulfill their home ownership dreams. Nurses, seize this special offer: LMI waived to 90% LVR, discounted rates, fast approval, and zero LMI on loans up to 90%. Save thousands! Apply now. The CalHFA VA program is a VA-insured loan featuring a CalHFA fixed interest rate first mortgage. This loan is a year fixed interest rate first mortgage. As part of Next Door Programs®, the largest national home buying program in the U.S., Nurse Next Door®is designed specifically for nurses and healthcare workers. A medical professional mortgage is a specialized mortgage program designed specifically for healthcare professionals. This type of mortgage is tailored to. Types of Mortgage Loans Available for Nurses · FHA Loans: The Federal Housing Administration (FHA) offers loans with lower down payments and more lenient credit. Fidelity Home Groups Heroes Program is designed to provide down payment assistance in the form of a grant equal to a minimum of 2% of the purchase price for. Official website of the Nurse Next Door Program. Grants, down payment assistance, home loans and other special programs for nurses and healthcare workers. Eligible occupations in underserved communities are: Nursing (including licensed practical nursing, nurse practitioners, registered psychiatric nurses and. A home loan program to help medical professionals, including residents, doctors, nurse practitioners and more fulfill their home ownership dreams. Nurses, seize this special offer: LMI waived to 90% LVR, discounted rates, fast approval, and zero LMI on loans up to 90%. Save thousands! Apply now. The CalHFA VA program is a VA-insured loan featuring a CalHFA fixed interest rate first mortgage. This loan is a year fixed interest rate first mortgage. As part of Next Door Programs®, the largest national home buying program in the U.S., Nurse Next Door®is designed specifically for nurses and healthcare workers. A medical professional mortgage is a specialized mortgage program designed specifically for healthcare professionals. This type of mortgage is tailored to.

The CalPLUS FHA program is an FHA-insured first mortgage with a slightly higher 30 year fixed interest rate than our standard FHA program and is combined with. Registered nurse loans are a specialty mortgage loan created to assist individuals new to the medical field the opportunity to quality for a home loan. Doctors, attorneys, CPAs, and other highly trained professionals can become homeowners sooner with a professional mortgage from Flagstar. VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you. We specialize in home loans for healthcare workers, offering innovative mortgage programs such as 0% down payment and % LTV up to $M. Healthcare Home Loans are a mortgage broker that specialises in providing home loan solutions to Healthcare Professionals. We offer tailored solutions that take. The CalHFA USDA Program is a USDA Guaranteed first mortgage loan program, which can be combined with the MyHome Assistance Program (MyHome). This loan is a Mortgages for Champions offers special home loans to various medical professionals, including home loans for registered nurses. One of the biggest perks to this. There are special home loans for healthcare workers when choosing Heroes Home Advantage. Heroes Home Advantage consists of former medical professionals. If you're a registered nurse or midwife earning at least $90ka year, you could get a home loan with a 10% deposit (an LVR up to 90%), without having to pay. If you want to use bonuses and OT to qualify, for FHA loan you would need to show 2 years of consistent OT and bonuses. There are exceptions. The Hero Home Loan Program for healthcare workers is a program that offers home loans to eligible healthcare workers. It is designed to help healthcare workers. Are you a nurse looking to step into homeownership? Our specialized nurse home loans and RN mortgages are designed just for you. At NEO Home Loans, we. If you are a veteran or active military member, you may be eligible for a VA loan. These loans are backed by the Department of Veterans Affairs and offer. If you're a nurse or healthcare worker and haven't owned a home in the last three years, you qualify for the Nurse Next Door® First-Time Home Buyer Program. For nurses and other healthcare workers, we offer specialized home loan programs designed to meet their unique needs. Our mortgage rates are tailored to. All loan types are available in connection with the Nurse Next Door Program, including conventional, FHA, VA and USDA. In addition, you may qualify for special. Our mortgage loans for healthcare professionals, including EMT, doctors, and nurses, will provide you with the discount you've earned. Remember, this discount. Additionally, nurse mortgages might offer specialized perks designed with nurses in mind, such as relocation assistance for traveling nurses or loan forgiveness. A construction-to-permanent loan is a specialized loan option designed for medical professionals looking to build their homes. This two-phase financing solution.