yan7.site

News

Best Home And Auto Insurance Companies In Ohio

Best Cheap Car Insurance in Ohio · Key Takeaways · Cheapest Car Insurance in Ohio: Grange · Cheapest Car Insurance Rates in Ohio for Teen Drivers: USAA and Erie. Wallace & Turner is a top-rated personal, commercial, life and health insurance agency serving all of Ohio. Work with trusted Ohio insurance professionals. The Best Home Insurance in Ohio for Auto-Owners and Erie are among the best home insurance companies in Ohio. Updated Mar 20, · 4 min read. Independent car insurance agents consider your needs and driving habits to find the best coverage. Because they aren't tied to a specific insurance company. insurance rates, nor do we tell an insurance company it must revise its rating plan unless the rating plan does not comply with Ohio insurance laws. Also. We offer insurance for every life moment. When you're ready to protect your home, car And we're independently recognized as one of the country's top insurers. You ought to check out Erie Insurance. Especially if you have a good driving history, their multi policy discount is good and the auto has rate. Our Recommended Top 15 · Providers · All Ohio Insurance · Martin & Lark Insurance Agency · The Florian Insurance Agency · Dabbelt Insurance · Augustine Insurance. Liberty Mutual understands the needs of Ohio homeowners and offers customized homeowners insurance coverage to fit your specific situation. Best Cheap Car Insurance in Ohio · Key Takeaways · Cheapest Car Insurance in Ohio: Grange · Cheapest Car Insurance Rates in Ohio for Teen Drivers: USAA and Erie. Wallace & Turner is a top-rated personal, commercial, life and health insurance agency serving all of Ohio. Work with trusted Ohio insurance professionals. The Best Home Insurance in Ohio for Auto-Owners and Erie are among the best home insurance companies in Ohio. Updated Mar 20, · 4 min read. Independent car insurance agents consider your needs and driving habits to find the best coverage. Because they aren't tied to a specific insurance company. insurance rates, nor do we tell an insurance company it must revise its rating plan unless the rating plan does not comply with Ohio insurance laws. Also. We offer insurance for every life moment. When you're ready to protect your home, car And we're independently recognized as one of the country's top insurers. You ought to check out Erie Insurance. Especially if you have a good driving history, their multi policy discount is good and the auto has rate. Our Recommended Top 15 · Providers · All Ohio Insurance · Martin & Lark Insurance Agency · The Florian Insurance Agency · Dabbelt Insurance · Augustine Insurance. Liberty Mutual understands the needs of Ohio homeowners and offers customized homeowners insurance coverage to fit your specific situation.

Best Homeowners Insurance In Ohio For August, State Farm has the best home insurance in Ohio, offering average premiums of $1, per year. We've saved. Who has the cheapest car insurance in Ohio? · $ lower than GEICO · $ lower than Progressive · $ lower than State Farm · $ lower than Allstate. Ohio auto insurance. Customized and reliable auto insurance close to home in Ohio car insurance agents consider your needs and driving habits to find the best. Columbus, Ohio: All "Home Insurance" results - September Showing of · Detwiler Brofford Insurance. 1. · Flanagan & Associates Insurance Agency. 2. SelectQuote shops and compares home and auto insurance rates from dozens of our trusted carriers to find you the lowest price. Ohio are Midland Company (The), State Auto Insurance, Root The company offers personal insurance products, such as automobile, homeowners, condo owners. Westfield offers the protection you need for your home, auto, business, farm — and more Best is an insurance industry rating organization, providing an. Had not been my experience, paid a little more for better care. Currently with Ohio Mutual for home and auto and pretty happy with their rates. good deal in Ohio. Here are a few featured discounts: Multi-policy discounts. Save up to 25% when you bundle home and auto policies with Allstate. American Family is the best home and auto insurance bundle company of This is based on our analysis of home and auto insurance rates, the amount you. Getting home insurance in Ohio has never been easier with American Family. Learn about our flexible home insurance policies and start a quote today. The best car insurance in Ohio is from The General because customers give The General positive reviews. For instance, The General has a user rating of out. While Cincinnati Insurance Company offers the cheapest average home insurance rates for a $K home in Ohio, Allstate offers the cheapest rates in Ohio for a. 1. Nationwide · 2. Progressive Insurance · 3. Wayne Insurance Group · 4. Epiq Insurance Agency · 5. Unitas Financial Services · 6. Ohio FAIR Plan Underwriting. What Are the Best Car Insurance Companies in Ohio for ? · USAA: + · Erie: 95+ · United Farm Bureau of IN Group: + · Hartford: + · Auto-Owners. State Farm is by far the largest insurer in Ohio in the homeowner and auto markets. State Farm collects five times more HO premiums than its next closest. Both coverages also protect against liability, such as in situations where you're responsible for causing bodily injury or property damage to others. Top Ad. #1 · USAA Insurance logo. USAA ; #2 · new jersey manufacturers insurance co. (njm) logo. Njm Insurance Group ; #3 · Goodville Mutual Casualty Company Logo. Goodville. Who has the cheapest car insurance in Ohio? · $ lower than GEICO · $ lower than Progressive · $ lower than State Farm · $ lower than Allstate. Best home insurance companies in Ohio · Cheapest rates: Buckeye Insurance Group · Best insurer for new homes: Ohio Mutual Insurance Group · Best insurer for.

Camping Trailer Insurance

See how much you could save when you get an RV insurance quote with Liberty Mutual and only pay for what you need. Call us at Acuity is different than most insurance companies. In addition to world-class claims service, we offer RV insurance, camper insurance, and travel trailer. Insure your travel/camping trailer against damage and loss caused by common risks, such as fire, storms, theft and collision. Property covered can vary, so what. As we mentioned earlier, you're not legally required to have RV insurance on travel trailers. The towing vehicle's liability portion of its auto insurance. The more you add, though, the more you'll pay. For reference, however, a Class A RV may cost around $2, dollar a year or more to insure, while a Class B may. Personal property coverage helps mitigate costs associated with losing covered personal property. It must be contained in, attached to or used in connection. Explore the wilderness with peace of mind with travel trailer insurance from Progressive. Get a free travel trailer insurance quote today. RV insurance. Our RV and motorhome insurance helps cover your Class A, B, C, Class B Plus, Super C and motorized recreational vehicles or truck/van camper if. Full-time RV insurance provides additional coverage for trailers and motorhomes used as a permanent residence for more than half the year. See how much you could save when you get an RV insurance quote with Liberty Mutual and only pay for what you need. Call us at Acuity is different than most insurance companies. In addition to world-class claims service, we offer RV insurance, camper insurance, and travel trailer. Insure your travel/camping trailer against damage and loss caused by common risks, such as fire, storms, theft and collision. Property covered can vary, so what. As we mentioned earlier, you're not legally required to have RV insurance on travel trailers. The towing vehicle's liability portion of its auto insurance. The more you add, though, the more you'll pay. For reference, however, a Class A RV may cost around $2, dollar a year or more to insure, while a Class B may. Personal property coverage helps mitigate costs associated with losing covered personal property. It must be contained in, attached to or used in connection. Explore the wilderness with peace of mind with travel trailer insurance from Progressive. Get a free travel trailer insurance quote today. RV insurance. Our RV and motorhome insurance helps cover your Class A, B, C, Class B Plus, Super C and motorized recreational vehicles or truck/van camper if. Full-time RV insurance provides additional coverage for trailers and motorhomes used as a permanent residence for more than half the year.

When your travel trailer or towable camper is on an ERIE auto insurance policy, you can be covered for physical damage while it's parked temporarily at a. Other than collision coverage is a standard coverage included in our travel trailer policy, and applies to direct, abrupt, and accidental loss, including fire. RV insurance starts at $ per year for trailers and around $ per year for motorhomes. The price goes up based on different factors. The value of the RV and. Hagerty is the premier insurance provider for Vintage Camper Trailers, we offer specialized coverages for your vintage RV. Complete your quote today! The Good Sam Insurance Agency specializes in insurance for all RVs, including travel trailers. Learn more about the protections we provide for your unique. A better kind of Stationary Travel Trailer insurance. · We do insurance better. And here's how. · We do insurance better. · Get covered in minutes. · Different. RV insurance protects vehicles like golf carts, motor homes and more. Contact your local COUNTRY Financial agent for information on insurance for an RV. Full-Timer Liability coverage provides personal liability protection when your travel trailer is parked and used as a dwelling or for recreational purposes. Safeco can insure almost any recreational vehicle. This includes Class A, B, and C motorhomes with values up to $1 million. We also cover fifth wheels and. Once you've found the best quote, you can relax knowing that you have found the cheapest trailer or RV coverage possible. If no online quotes are available, you. GEICO offers a range of coverages such as total loss replacement and vacation liability to protect your RV and provide you with peace of mind while on the road. RV insurance quotes -- free from an experienced AAA insurance agent. We offer recreational vehicle and travel trailer insurance policies to fit your needs. An insurance policy on a travel trailer should have a very reasonable cost— usually ranging between $ and $ per year. The exact cost can vary depending on. Travel trailers are non-motorized RVs. This means that, in most states, insurance coverage is not legally required. However, if you are currently paying. Get a quote and bind your RV policy online in minutes with the Good Sam Insurance Agency. You can also call to speak with an agent. USAA offers RV insurance for your motorhome, travel trailer, camper and fifth wheel. Learn more about RV insurance costs, rates and coverage. 24/7 claim service, from RV specialists. When it comes down to it, insurance coverage is only as good as the service provided in the unfortunate event of a. With belairdirect RV Comfort insurance, you could receive up to $, in coverage if ever you are held liable for damage to a rented or borrowed vehicle that. Get a free RV and travel trailer insurance quote with Amica today. Explore our different coverage options and learn how you can protect your RV or trailer. RV insurance from Nationwide offers protection when you need it most. Find out more about our affordable rates and start your free quote today.

To Live Off The Grid

Living off the grid means living without connections to public utilities like sewer, water, and electrical lines. It also usually means living a minimalist. Off Grid Living How to Live Off The Grid! Homesteading & Survival! Sustainability. Sustainable living and renewable energy, new innovative technology. Living off the grid means you are not connected to the electrical power grid that supplies most of the electricity in your state or nation. Living off-grid is living a completely self-sufficient lifestyle. It means you don't rely on public food, housing, and utility sources. not connected to the main electricity grid (= system of connected wires and power stations): Solar power is useful in off-the-grid areas. This guide explores what it means to live off-grid, the advantages and disadvantages of this lifestyle, and the essential tips to help you achieve success. Rent a room instead of an apartment, cut back on every possible expense. When you are able to buy some land, live in a tent. Save money build a. live off the grid. 1. To live without one's home connected to municipal utility systems, such as the water supply or the main electrical grid. I just need to. As well as offering independence, a connection to nature, and a sense of community, off-grid life is a way of living much more sustainably. Some off-gridders. Living off the grid means living without connections to public utilities like sewer, water, and electrical lines. It also usually means living a minimalist. Off Grid Living How to Live Off The Grid! Homesteading & Survival! Sustainability. Sustainable living and renewable energy, new innovative technology. Living off the grid means you are not connected to the electrical power grid that supplies most of the electricity in your state or nation. Living off-grid is living a completely self-sufficient lifestyle. It means you don't rely on public food, housing, and utility sources. not connected to the main electricity grid (= system of connected wires and power stations): Solar power is useful in off-the-grid areas. This guide explores what it means to live off-grid, the advantages and disadvantages of this lifestyle, and the essential tips to help you achieve success. Rent a room instead of an apartment, cut back on every possible expense. When you are able to buy some land, live in a tent. Save money build a. live off the grid. 1. To live without one's home connected to municipal utility systems, such as the water supply or the main electrical grid. I just need to. As well as offering independence, a connection to nature, and a sense of community, off-grid life is a way of living much more sustainably. Some off-gridders.

not connected to the main electricity grid (= system of connected wires and power stations): Solar power is useful in off-the-grid areas. It's likely to be cheaper than normal living once you get the dwelling together! Here are five examples of off-grid living to consider. A program, online community & step-by-step guides for anyone that wants to buy land, start a homestead, have cabin rentals, a retreat centre, regenerative farm. Off-grid living saves an immeasurable amount of energy, including roughly 30% of the energy that otherwise gets lost in transmission via the current grid. Living off the grid means being disconnected from the electric utility grid and generating your own power through solar panels. Discover more! Living Off the Grid: What to Expect While Living the Life of Ultimate Freedom and Tranquility [Gary Collins] on yan7.site *FREE* shipping on qualifying. live off the grid. 1. To live without one's home connected to municipal utility systems, such as the water supply or the main electrical grid. I just need to. This page will define off-grid living, outline its most common forms, and provide guidance for getting started in this lifestyle. From gathering knowledge to finding the perfect location, building a home, and planning your power and water sources, there are crucial steps to take. If you're not tied to a physical grid or network, you live off the grid. This means that if you have no mains electrical power or water connection, you're. The term "off-the-grid" traditionally refers to not being connected to the electrical grid, but can also include other utilities like water, gas, and sewer. Living off grid in Canada presents a unique opportunity for those seeking a simpler, more self-sufficient lifestyle. While living off the grid is technically not illegal in any of the 50 US states, some of the essential infrastructure aspects of going off-grid are either too. Most people's off-grid living plans focus around a cabin of some sort on rural property. However, off-grid living on boats and RV's are also possible. Live. Playlists. Community. Search. Couple Builds House Off Grid - Framing DIY Off Grid Living: Building A Barn For Free Using Milled Lumber And. Sustainability is not just an ideal in off-grid living either; it's a practice woven into the fabric of everyday life. From composting. Two common choices for an off-grid home are shipping container homes and tiny houses. “Most of our clients use these units in off-the-grid applications,” says. I'm sharing some insights about what you can expect if you live off the grid. In this video, I share the most important tips to approach the planning of your. First off, try to find some alone time to sit quietly and visualize the off-grid lifestyle that you would like to live. Living off-grid is about much more than.

What Is A Credit Card Chargeback

If the supplier will not refund your money and you paid using a credit or debit card, your card provider – usually your bank – may agree to reverse the. A credit card chargeback is when a bank reverses an electronic payment to trigger a dispute resolution process. Chargeback lets you ask your card provider to refund a payment on your credit card when a purchase has gone wrong. You should always contact the seller first. When a cardholder disputes a charge on their credit card, a credit card chargeback is filed against the associated merchant. There are four general credit. A credit card chargeback is a process in which a card owner can reclaim money directly from the issuer after disputing a purchase charge. Chargebacks are a real and growing threat for online merchants. They drain revenue, damage customer relationships, and can even threaten a merchant's ability to. Chargebacks are a consumer protection tool that allow consumers to get their money back for fraudulent charges or purchases that don't live up to standards. When a cardholder disputes a purchase on their debit or credit card, they set off a series of events called the chargeback process. Chargeback exists for both credit and debit card purchases. It is a mechanism for your card provider to reclaim money from the retailer's bank. If the supplier will not refund your money and you paid using a credit or debit card, your card provider – usually your bank – may agree to reverse the. A credit card chargeback is when a bank reverses an electronic payment to trigger a dispute resolution process. Chargeback lets you ask your card provider to refund a payment on your credit card when a purchase has gone wrong. You should always contact the seller first. When a cardholder disputes a charge on their credit card, a credit card chargeback is filed against the associated merchant. There are four general credit. A credit card chargeback is a process in which a card owner can reclaim money directly from the issuer after disputing a purchase charge. Chargebacks are a real and growing threat for online merchants. They drain revenue, damage customer relationships, and can even threaten a merchant's ability to. Chargebacks are a consumer protection tool that allow consumers to get their money back for fraudulent charges or purchases that don't live up to standards. When a cardholder disputes a purchase on their debit or credit card, they set off a series of events called the chargeback process. Chargeback exists for both credit and debit card purchases. It is a mechanism for your card provider to reclaim money from the retailer's bank.

Please contact your card-issuing bank's hour Customer Service Hotline to lodge your dispute. Your card-issuing bank will advise you on the process which. When a cardholder disputes a purchase on their debit or credit card, they set off a series of events called the chargeback process. Were a victim of fraud – their credit or debit card was stolen or used without their consent. Were charged twice. Most creditors won't allow you to dispute a credit card charge after 90 days have passed. Most will have deadlines between days. A chargeback is like a refund - it reverses a transaction made on a debit or credit card. Chargeback is a term used by credit and debit card providers. A chargeback is like a refund, where a transaction made on a debit or credit card is reversed. It happens when the cardholder disputes the payment. In this comprehensive guide, we'll delve into the intricacies of credit card chargebacks, exploring their nuances from both the consumer and merchant/banking. Chargeback fraud is when a person knowingly makes a purchase with a credit card, then disputes the charge with their credit card provider. You can ask your bank to 'reverse the transaction' and get your money back via chargeback. It's part of Visa, Mastercard and Amex's own rules. When a cardholder disputes a credit card payment, the chargeback process is set in motion. The cardholder contacts their credit card issuer, providing details. A credit card chargeback is when a bank reverses an electronic payment to trigger a dispute resolution process. Please contact your card-issuing bank's hour Customer Service Hotline to lodge your dispute. Your card-issuing bank will advise you on the process which. A chargeback is a return of money to a payer of a transaction, especially a credit card transaction. Most commonly the payer is a consumer. A chargeback is where money paid to a retailer for an item is reversed out of its account and refunded to yours. Here's a six-step guide to improving your odds of winning a chargeback dispute. Step 1: Be ready—collect customer transaction details upfront. Let's discuss the ins and outs of debit card chargebacks and go over the differences between chargebacks for credit card purchases and those for debit cards. Most creditors won't allow you to dispute a credit card charge after 90 days have passed. Most will have deadlines between days. If you believe that a credit card transaction has been posted to your account in error, you may submit a credit card dispute within 60 days of the date that. In this comprehensive guide, we'll delve into the intricacies of credit card chargebacks, exploring their nuances from both the consumer and merchant/banking.

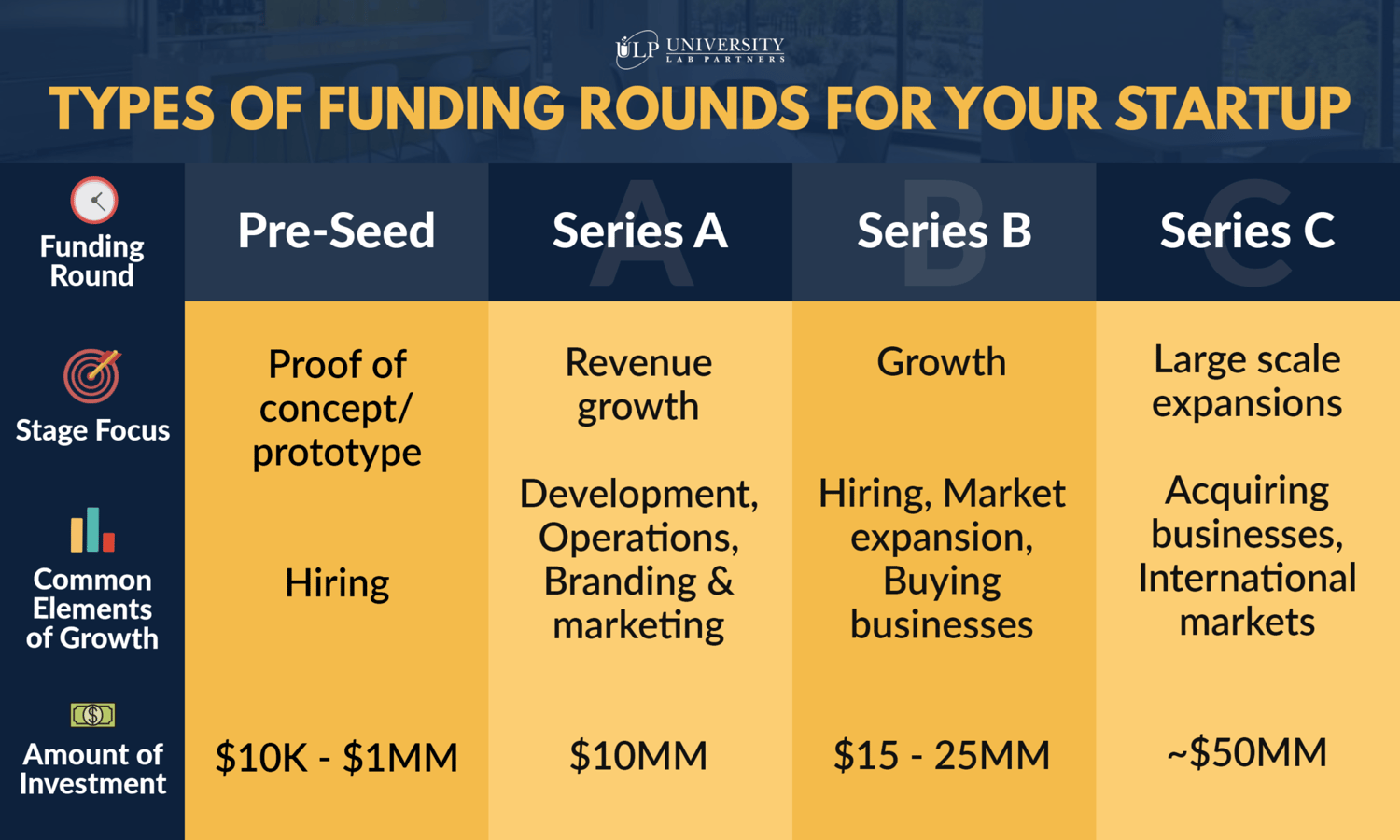

Series A Funding Startup

Series A funding is meant to last between six months and two years to guide development. Business owners need a clear plan for how much money they will need in. In summary, startup funding follows an alphabetic series from A to E and beyond to help companies scale through stages from idea to IPO. With. What is Series A? Series A is the next round of funding after the seed funding. By this point, a startup probably has a working product or service. And it. We pull startup funding data every week and currently have thousands of $30,,, Venture - Series Unknown, Jul Phaidra, yan7.site Series A, B, and C funding rounds are separate fundraising events businesses use to raise capital. Each round is named for the series of stock being issued. Pre-seed, seed, series A, series B, to IPO. Find out what each round means, the criteria, the type of investors, and more. Series A funding is a type of equity-based financing that is considered the first major round of external funding startups can raise. Series A financing refers to an investment in a privately-held start-up company after it has shown progress in building its business model and demonstrates. What is Series A Funding? · Series A funding, (also known as Series A financing or Series A investment) means the first venture capital funding for a startup. Series A funding is meant to last between six months and two years to guide development. Business owners need a clear plan for how much money they will need in. In summary, startup funding follows an alphabetic series from A to E and beyond to help companies scale through stages from idea to IPO. With. What is Series A? Series A is the next round of funding after the seed funding. By this point, a startup probably has a working product or service. And it. We pull startup funding data every week and currently have thousands of $30,,, Venture - Series Unknown, Jul Phaidra, yan7.site Series A, B, and C funding rounds are separate fundraising events businesses use to raise capital. Each round is named for the series of stock being issued. Pre-seed, seed, series A, series B, to IPO. Find out what each round means, the criteria, the type of investors, and more. Series A funding is a type of equity-based financing that is considered the first major round of external funding startups can raise. Series A financing refers to an investment in a privately-held start-up company after it has shown progress in building its business model and demonstrates. What is Series A Funding? · Series A funding, (also known as Series A financing or Series A investment) means the first venture capital funding for a startup.

The seed round is the first official funding stage. Here, early-stage startups exchange equity for capital to finance growth initiatives such as product. Well-known venture capital firms that participate in Series A funding include Sequoia Capital, Benchmark Capital, Greylock and Accel Partners. By this stage, it. VCs assess the alignment between a startup's development stage and the associated risks to optimize the funding amount. This adequation is crucial, as it. But despite their differences, all startups go through the same fundraising journey, from seed to series, to raise the capital needed to sustain and grow their. Series A rounds are traditionally a critical stage in the funding of new companies. Series A investors typically purchase 10% to 30% of the company. The. Series A funding usually comes from venture capital financing, although angel investors may also be involved. Additionally, more companies are using equity. Seed funding • Startups • Venture. What Did It Take To Raise A Series A Round In ? Guest Author. January 31, Startup Money. Guest Author. What are series funding? Series funding is a multi-round process in which startup companies receive money from external investors in exchange for equity, or. Seed funding • Startups • Venture. What Did It Take To Raise A Series A Round In ? Guest Author. January 31, Startup Money. Guest Author. Josh Kopelman on why raising a Series A is harder than ever, and how startups can adapt to survive the changing investment landscape. Series A financing (also known as series A round or series A funding) is one of the stages in the capital-raising process by a startup. Series A Funding. The Series A round funding comes after a startup has an established business idea and vision, a pitch deck to show potential investors how. Series B fundraising occurs when a startup has passed a number of milestones in its development and operation. Following on from series A, the business will be. Series E funding is the fifth major round of fundraising that a startup might go through. This round occurs late in the fundraising process, and usually takes. Technically series A funding is just the first round. It can be for any amount for percentage of the company. Next round B is precisely the same. A funding round occurs when a startup seeks to raise capital from either new or existing investors; it concludes when said transaction is complete. Pre-seed funding. Pre-seed is the very first priced equity round a startup raises at its nascent stage. Most startups at this stage only have an idea. In every funding round, money is generally exchanged for company equity, meaning the investors expect a return on their investment. Funding rounds can be. The seed round is the first official funding stage. Here, early-stage startups exchange equity for capital to finance growth initiatives such as product. How Series A Funding Works · ARR. The expectation is that your business is generating revenue at Series A, often in the range of $2 million to $5 million of ARR.

Stock Screener Indicators

Technical stock screeners allow you to filter stocks according to many of the same price-dependent technical indicators that you would use on a stock chart. So. My Stock Screens · Universe · Price / Volume · Moving Averages · Oscillators · Trend Indicators · Line Studies · Volatility · Ichimoku. Use the Stock Screener to scan and filter instruments based on market cap, dividend yield, volume to find top gainers, most volatile stocks and their. FAQ · How do I find good stocks? The best way to find good stocks is by analyzing multiple indicators and unique datasets. · What is a stock screener? A stock. The Stock Screener Pro allows you to combine multiple technical indicators and scan the stock market. This will save you a lot of time as you no longer need. Stock Screener - research and filter stocks based on key parameters and metrics such as stock price, market cap, dividend yield and more. Technical indicator added to find trending stocks. ; 8. Castrol India, ; 9. Swaraj Engines, ; Ingersoll-Rand, ; Indian. Stock Screener app for android is free and searches the US stock market based on technical analysis and stock chart patterns for stock trading. The best screeners have a broad range of stocks in their databases that can be filtered with precision using both preset and custom criteria. The interface. Technical stock screeners allow you to filter stocks according to many of the same price-dependent technical indicators that you would use on a stock chart. So. My Stock Screens · Universe · Price / Volume · Moving Averages · Oscillators · Trend Indicators · Line Studies · Volatility · Ichimoku. Use the Stock Screener to scan and filter instruments based on market cap, dividend yield, volume to find top gainers, most volatile stocks and their. FAQ · How do I find good stocks? The best way to find good stocks is by analyzing multiple indicators and unique datasets. · What is a stock screener? A stock. The Stock Screener Pro allows you to combine multiple technical indicators and scan the stock market. This will save you a lot of time as you no longer need. Stock Screener - research and filter stocks based on key parameters and metrics such as stock price, market cap, dividend yield and more. Technical indicator added to find trending stocks. ; 8. Castrol India, ; 9. Swaraj Engines, ; Ingersoll-Rand, ; Indian. Stock Screener app for android is free and searches the US stock market based on technical analysis and stock chart patterns for stock trading. The best screeners have a broad range of stocks in their databases that can be filtered with precision using both preset and custom criteria. The interface.

I'm eager to explore the possibilities of the "Stock Screener" feature and would love some guidance on using my own custom Pinescript indicator. The relative strength index (RSI) is a momentum indicator. This is a nice parameter to use for technical stock screeners because it's relatively straightforward. Technical indicators highlight a particular aspect of price or volume behavior on a stock chart to provide valuable insights and help with analysis. Indicator Interpretation: The analysis of 12 indicators points to an overall trading status of a certain stock: Hyper>Overbought: a danger signal. The following quarterly fundamental indicators have become available for use in the Formula Screener: Enterprise Value, EBIT, Return On Equity, Return On. A stock screener is a tool used to help investors and traders find stocks that meet their investing criteria. Long-term investors may look for stocks based on. The easiest way to scan for stocks to trade everyday in all major markets! All technical indicators, symbols, charts are available for Indian. Create your own stock screener with over different screening criteria from Yahoo Finance. A Fundamental Analysis Report is available for every stock in our database and is updated daily. These reports are easy to understand and analyze the. A free stock screener to search, filter and analyze stocks by different indicators and metrics. The screener data is updated every 5 minutes. A technical stock screener is a tool that allows you to shortlist stocks that meet the predefined technical criteria you choose. The primary goal of the. The only thing keeping me from buying a subscription for TradingView right now is the lack of support for custom indicators in the stock. Stock screeners are powerful tools that allow investors to filter and analyze stocks based on specific criteria, streamlining the process of identifying. Zacks Stock Screener is a best in class tool for helping you find the right stocks for your investment strategy. One of the most used momentum indicators is the relative strength index (RSI). RSI measures the stock's recent trading strength, trend change and scale of the. Stock Screener - research and filter stocks based on key parameters and metrics such as stock price, market cap, dividend yield and more. Technical Stock Screener presents a trend following technical indicators stocks trading signals. With Stock Screener, you can analyze stocks based on various financial ratios, timeframes, and technical indicators. Identify trending, ranging or potential breakout stocks with the Stock Screener Twiggs® indicators is a Registered Trade Mark of Incredible Charts Pty Ltd.

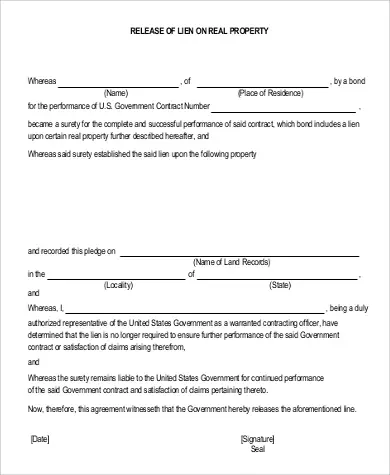

How To Pay Off A Lien On House

Simply paying off the loan will not, however, clear the mortgage lien in the public record. A corresponding release, satisfaction, or reconveyance of deed must. If you've had trouble getting payment from a debtor, even after retaining the services of a debt collection agency or debt collection attorney, you may be able. You may be able to simply pay the amount due and ask the company to file a release of lien with the court (or possibly the assessor/recorder). Parties affected by a lien claim can file a petition to discharge a lien by paying the amount owing, but sometimes courts will remove lien claims if they can be. Pay Off the Lien – Once you determine that the lien is valid, the simplest method for removing it is to pay it off. · Request a Release-of-Lien Form – After. The short answer is that you should be able to pay off your state or IRS tax debt in full to get rid of your lien. But as with just about everything involving. A beneficiary to the house or anyone else can choose to pay the lien off from their own funds. As a last resort, you can simply allow the creditor to seize the. Pay a Lien or Loan · Paying in person ensures the interest calculation and payoff total is exact, so you can avoid an overpayment or underpayment. · You can mail. A property lien is a legal claim on assets that allows the holder to obtain access to the property if debts are not paid. A property lien must be filed and. Simply paying off the loan will not, however, clear the mortgage lien in the public record. A corresponding release, satisfaction, or reconveyance of deed must. If you've had trouble getting payment from a debtor, even after retaining the services of a debt collection agency or debt collection attorney, you may be able. You may be able to simply pay the amount due and ask the company to file a release of lien with the court (or possibly the assessor/recorder). Parties affected by a lien claim can file a petition to discharge a lien by paying the amount owing, but sometimes courts will remove lien claims if they can be. Pay Off the Lien – Once you determine that the lien is valid, the simplest method for removing it is to pay it off. · Request a Release-of-Lien Form – After. The short answer is that you should be able to pay off your state or IRS tax debt in full to get rid of your lien. But as with just about everything involving. A beneficiary to the house or anyone else can choose to pay the lien off from their own funds. As a last resort, you can simply allow the creditor to seize the. Pay a Lien or Loan · Paying in person ensures the interest calculation and payoff total is exact, so you can avoid an overpayment or underpayment. · You can mail. A property lien is a legal claim on assets that allows the holder to obtain access to the property if debts are not paid. A property lien must be filed and.

Simply put, a property lien is a legal claim on a person's assets. The individual or entity holding the lien gains access to the property if the owner fails to. When you pay a tax lien amount in full, the IRS will provide you with a release of the notice of federal tax lien about 30 days after you pay off your tax debt. The IRS releases your lien within 30 days after you have paid your tax debt. A lien secures the government's interest in your property when you don't pay your. If you pay off the underlying debt, the creditor will agree to release the lien. The creditor then files a release with the same authority with which it. Only if the house is foreclosed or liene due to back taxes. Then they can go through the process of selling the house to satisfy the liens. If the liens are. Start by asking for a copy of the lien, all pages (if more than one) and a copy of your title report. On those documents you should be able to. Pay a Lien or Loan · Paying in person ensures the interest calculation and payoff total is exact, so you can avoid an overpayment or underpayment. · You can mail. The only forms of payment are cash, certified check or money order. The Collector will notify the lien holder that payment has been received, and request the. 5 Steps To Put A Lien On A House · Check for statute of limitations. · File a claim in court. · Serve court papers. · Attend court hearing. · Record lien. Pay Off the Lien: The most straightforward method to remove a lien is to pay what you owe. · Request a Release-of-Lien Form: If you have already cleared the debt. Either you or your parents (whoever actually owns the property), will have to pay the debt before that property can be sold. The purpose of the. For involuntary liens, the property owner must pay their creditor what they owe, draft a lien release document, and have the creditor sign it before having the. Simply paying off the loan will not, however, clear the mortgage lien in the public record. A corresponding release, satisfaction, or reconveyance of deed must. The lien remains on the property and could affect the sale of the property. Any unpaid lien will be sent to the tax roll and become a debt owed as taxes. If the. The short answer is that you should be able to pay off your state or IRS tax debt in full to get rid of your lien. But as with just about everything involving. Pay off the debt. If it's valid, pay your creditor in full. Sometimes creditors are willing to negotiate, so see if the company has any leeway if you're willing. Banks look for liens when they're financing (for example if the property sells) or refinancing a property. So, if there's a lien you will probably get paid when. The primary mortgage is usually paid first, followed by secondary liens like home equity loans. If additional liens exist, they are addressed according to their. Why? Because the lien gives the creditor an ownership interest in the property that won't go away unless you surrender the property, pay off the debt, lose. Mortgage – A mortgage lien is a claim to the property if you don't pay back your mortgage in full. Once your mortgage and interest is completely paid off.

How To Self Insure Your Home

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

The Division of Workers' Compensation has the regulatory authority over employers who self-insure their workers' compensation liability. home page. Home · About · Español · Polski · Resources for · Resources for Employers may obtain permission to insure themselves for their workers' compensation. When you self-insure, you don't purchase insurance coverage. Instead, you set money aside to be used in the event of an incident. Some insurers won't insure you if you own certain breeds of dogs. • Operating a business from your home. Know How to Save. Always be sure to shop around. Your browser does not support iFrames. New York State Home. Services · News self-insure in New York. Employers may apply to self-insure for disability. Several factors may affect the cost of your manufactured home insurance policy. Self-insure: If you are under insured, cannot get coverage you can. You may self-insure by assuming the entirety of a financial risk, or a portion of it. For example, the deductibles you have on your insurance policies are an. Loss of dwelling use, pays additional living expenses if you are forced to live elsewhere while your home is being repaired or until you can move into a new. Self-insurance involves setting aside your own money to pay for a possible loss instead of purchasing insurance and expecting an insurance company to reimburse. The Division of Workers' Compensation has the regulatory authority over employers who self-insure their workers' compensation liability. home page. Home · About · Español · Polski · Resources for · Resources for Employers may obtain permission to insure themselves for their workers' compensation. When you self-insure, you don't purchase insurance coverage. Instead, you set money aside to be used in the event of an incident. Some insurers won't insure you if you own certain breeds of dogs. • Operating a business from your home. Know How to Save. Always be sure to shop around. Your browser does not support iFrames. New York State Home. Services · News self-insure in New York. Employers may apply to self-insure for disability. Several factors may affect the cost of your manufactured home insurance policy. Self-insure: If you are under insured, cannot get coverage you can. You may self-insure by assuming the entirety of a financial risk, or a portion of it. For example, the deductibles you have on your insurance policies are an. Loss of dwelling use, pays additional living expenses if you are forced to live elsewhere while your home is being repaired or until you can move into a new. Self-insurance involves setting aside your own money to pay for a possible loss instead of purchasing insurance and expecting an insurance company to reimburse.

Home · About · Español · Polski · Resources for · Resources for Employers may obtain permission to insure themselves for their workers' compensation. Political subdivisions must also provide workers' compensation coverage to their employees, and they may elect to self-insure those benefits. Employer. Contact your insurance agent before you move your mobile home to another location. Since you are actually “self-insuring” for the deductible amount. Home > Insurance Division > Solvency Regulation > NJ Self Insurance for Motor Vehicle Liability and Workers' Compensation. Self Insurance. Please note: All. Homeowners who opt for self-insurance regularly set money aside to pay for any damages to their homes rather than purchasing an insurance policy. Home repairs. Loss of dwelling use, pays additional living expenses if you are forced to live elsewhere while your home is being repaired or until you can move into a new. If we already have a current SI-3 on file for your company, it is not necessary to include another with this application. If you are not specifically. Realize that if you decide to self-insure all or some of the risks faced by your business, it's in your best interest to reduce those risks wherever possible. Employers who wish to self-insure must provide three years' audited GAAP financial statements with their application. Once approved, the self-insurer is. Know Your Health Insurance Rights · Rates [redirect] · Medicare · Short-Term Self Insurance. Home · Licensing · Who Does Commerce License? Insurance · Self. Employers wanting to self-insure their workers' compensation liabilities must apply to the Office of Self-Insurance Plans (OSIP) for approval. The private. Self-insurance allows an employer to pay its own workers' compensation losses rather than buy an insurance policy. In Texas, private employers can apply for. Home · Resources forCurrently selected · Resources for Employers may obtain permission to insure themselves for their workers' compensation liabilities. In order to best protect your family, your home, and your possessions, it is Often, people concern themselves only with big ticket items purchased for use in. Home; About Us. The Fund · Governance · Board of Trustees · Staff · Organization Self Insurance Your Best Bet · Member Eligibility · Membership · Becoming A. For example, some tenants prefer to self-insure rather than purchase renter's insurance to protect their assets in the rental. If you have no debt and a. If you have decided to self-insure it is recommended that you work with an estate and elder law attorney to make sure your assets are protected. More people are. Home – Navbar · About · About the Director · Department Overview · Department Send your documentation to the below fax number, email or mailing address. your browsing experience. To update Internet Explorer to Microsoft Edge UI Home · Claimants · Employers · Service Providers. WORKPLACE INJURY. WC Home.

Whats A Good Asset To Buy

Stocks are often a riskier investment than bonds, but they also have the potential to generate higher returns. Bonds. When you buy a bond, you're loaning money. What is a mutual fund? The old rule of thumb used to be that you should subtract your age from - and that's the percentage of your portfolio that you. For sure, buying used is the better value option. Can also be the biggest headache especially if you're buying repo'd units or buying from. State Street provides investment servicing, investment management, investment research and trading services to institutional investors worldwide. Factors are the foundation of investing—broad, persistent drivers of returns across asset classes. Understand how factors work to better capture the. For example, you may invest more heavily in cash or cash equivalents in your down payment fund if you're getting ready to buy a house, while simultaneously. Have you ever wanted to invest in rental real estate without managing the property (and tenants) yourself? Well, now you can! An income generating asset such as. An asset is any investment that you expect to return more money in the future. While cash and CDs are technically assets, stocks and bonds are usually the core. Bonds are a great choice if you're seeking income-generating assets with a paper portfolio. Investment-grade bonds are “easy.” You simply buy the bond (or bond. Stocks are often a riskier investment than bonds, but they also have the potential to generate higher returns. Bonds. When you buy a bond, you're loaning money. What is a mutual fund? The old rule of thumb used to be that you should subtract your age from - and that's the percentage of your portfolio that you. For sure, buying used is the better value option. Can also be the biggest headache especially if you're buying repo'd units or buying from. State Street provides investment servicing, investment management, investment research and trading services to institutional investors worldwide. Factors are the foundation of investing—broad, persistent drivers of returns across asset classes. Understand how factors work to better capture the. For example, you may invest more heavily in cash or cash equivalents in your down payment fund if you're getting ready to buy a house, while simultaneously. Have you ever wanted to invest in rental real estate without managing the property (and tenants) yourself? Well, now you can! An income generating asset such as. An asset is any investment that you expect to return more money in the future. While cash and CDs are technically assets, stocks and bonds are usually the core. Bonds are a great choice if you're seeking income-generating assets with a paper portfolio. Investment-grade bonds are “easy.” You simply buy the bond (or bond.

Gains from stocks have historically helped investors keep pace with inflation and taxes—doing a better job than bonds or cash. The key is having enough to. 10 Best Dividend Aristocrats to Buy Now. Susan Dziubinski. Recommended. 10 Best Dividend Stocks · How to Build a Portfolio · 33 Undervalued Stocks · 10 Best. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Investments in stocks and bonds. Assets can range from cash, raw materials and stock, to office equipment, buildings and intellectual property. What is an asset in business? In business terms. In short stocks and or real estate are what most people invest in. There are asset classes for cars, artwork, precious metals, etc. but those. Usually, you buy units in these managed funds, the price of which fluctuates according to the performance of the underlying investments. 4. Investing in. What is a Brokerage Account · Retirement Major purchases or expenses: A HELOC can be a great way to fund a major purchase or cover a large expense. ACTION STEP: Paper Assets such as Stocks, ETFs, Bonds or REITs are the easiest to own and provide the most passive form of income. Consider buying in an. Liquid assets are easy to turn into cash with little loss in value, which makes them great for paying for unexpected costs. Cash in checking, savings. Real estate or other tangible assets – Real estate and other physical assets are considered an asset class that offers protection against inflation. The. Your home is likely your most valuable asset, and the value that you assign to it will have a great impact on your net worth calculation. A qualified real. A hedge against inflation includes assets that often outperform during inflationary times. Read how gold, real estate, and bonds are inflation hedges. Real estate is also a great beneficiary of inflation. It benefits from rising rents and rising property values. And when stocks and bonds are declining, mainly. asset you're investing in. Ask yourself how comfortable you feel with Choosing one of the best robo-advisors can help you automate your investing strategy. The Goldman Sachs Group, Inc. is a leading global investment banking, securities, and asset and wealth management firm that provides a wide range of. You can buy individual bonds through most major brokers, but for most investors, the best way to go is to buy ETFs and mutual funds that invest in bonds on your. Other great examples of liquid investments include U.S. Treasury bills (T-bills), bonds, mutual funds, and money market funds, which are a type of mutual fund. 1. List Your Assets · Cash · Accounts receivable (money owing) · Customer deposits · Office furniture and equipment · Cell phones · Computer hardware and software. Life with these assets stabilizes families, increases agency, and strengthens communities. AFN explores and promotes the best ways to build assets, and in this. What is an asset class? An asset class is a grouping of investments based on shared behaviors, characteristics, and regulations. Equities and cash are two of.

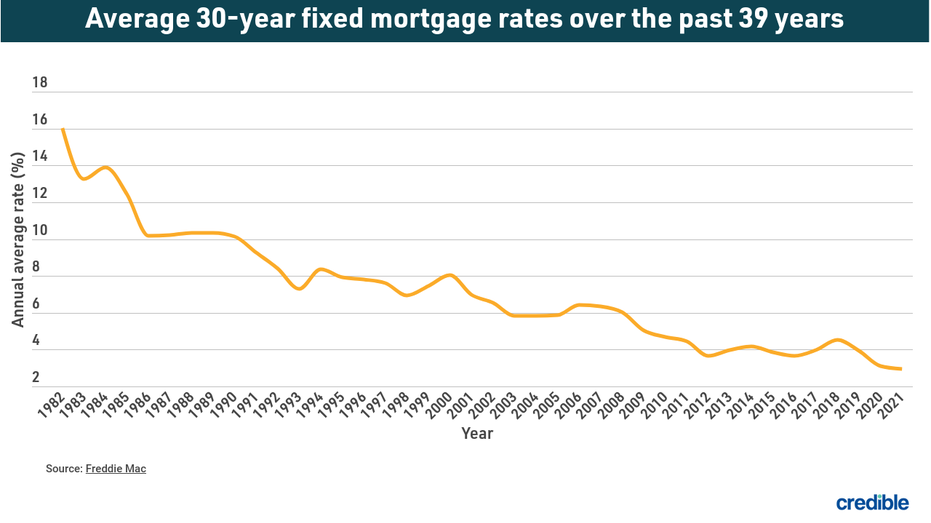

What Is The Current Refinance Rate For 15 Year Fixed

The current average rate on a year refinance is % compared to the rate a week before of %. The week high. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $2, At the time they refinance, current rates for a year mortgage are at %, while year fixed rates are averaging %. Shorter terms. Another reason is to shorten the terms of your mortgage. This could mean moving from a year to a year mortgage, for. 30, , the benchmark year fixed refinance rate is %, FHA year fixed refinance rate is %, jumbo year fixed refinance is %, and year. How Do I Qualify For A Year Fixed? · General minimum 3% - % down payment · Minimum - qualifying FICO® Score · Debt-to-income ratio (DTI) of no. Check out current refinance rates for a year conventional fixed-rate loan. These rates and APRs are current as of 08/28/ and may change at any time. That year, the average annual rate on year fixed mortgages was %. As the country plunged into another recession, mortgage rates continued to fall. The. The average APR on a year fixed-rate mortgage remained at % and the average APR for a 5-year adjustable-rate mortgage (ARM) rose 3 basis points to The current average rate on a year refinance is % compared to the rate a week before of %. The week high. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $2, At the time they refinance, current rates for a year mortgage are at %, while year fixed rates are averaging %. Shorter terms. Another reason is to shorten the terms of your mortgage. This could mean moving from a year to a year mortgage, for. 30, , the benchmark year fixed refinance rate is %, FHA year fixed refinance rate is %, jumbo year fixed refinance is %, and year. How Do I Qualify For A Year Fixed? · General minimum 3% - % down payment · Minimum - qualifying FICO® Score · Debt-to-income ratio (DTI) of no. Check out current refinance rates for a year conventional fixed-rate loan. These rates and APRs are current as of 08/28/ and may change at any time. That year, the average annual rate on year fixed mortgages was %. As the country plunged into another recession, mortgage rates continued to fall. The. The average APR on a year fixed-rate mortgage remained at % and the average APR for a 5-year adjustable-rate mortgage (ARM) rose 3 basis points to

Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Compare year fixed mortgage refinance rates from top mortgage lenders, tailored to you. Get actual prequalified rates in minutes. 15 Year Mortgage Rate is at %, compared to % last week and % last year. This is higher than the long term average of %. The 15 Year Mortgage. Current Fifteen Year Mortgage Rates Available Locally ; Beeline Loans, Inc. NMLS # · % · $1, /mo · % ; New American Funding, LLC. NMLS # Year Fixed Rate. Interest%; APR%. More details for Year Fixed Rate. Year Fixed-Rate VA. Interest%; APR%. More details for Year Fixed. A fixed-rate loan of $, for 30 years at % interest and % APR will have a monthly payment of $1, Taxes and insurance not included; therefore. Refinance Rates Today · Term Length Options: · Rate Range: · Year Fixed Rate · % - % APR · Year Fixed Rate · % - % APR · Year Fixed Rate. Today. The average APR for the benchmark year fixed-rate mortgage fell to %. Last week. %. year. What is the current rate for a year, fixed-rate mortgage? Find out what the current year, fixed-rate mortgage rates look like and apply today! Refinance rates ; yr fixed · % · % ; yr fixed FHA · % · % ; yr fixed · % · % ; yr fixed · % · %. Average Mortgage Rates, Daily ; 15 Year Fixed. %. % ; 10 Year Fixed. %. % ; 30 Year Refinance. %. % ; 15 Year Refinance. %. %. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. As of August 28, , the average year fixed mortgage APR is %. Terms Explained. 3. Additionally, the current national average year fixed refinance rate remained stable at %. The current national average 5-year ARM refinance rate is. Year FixedAdjustable-Rate MortgageBorrowSmart AccessFHA LoanHomeReady Learn About Year Fixed Loans. Year Fixed. Rate%. /. APR%. Points. Today's competitive refinance rates ; year · % · % · · $1, ; year · % · % · · $1, ; year · % · % · · $1, Rates on year mortgages are usually lower than year mortgage rates, which means you can save a lot by simply choosing a year loan term. Change the length of your mortgage. If you want to be mortgage-free faster and pay less interest, you could change your year loan term to a year. year fixed rate:APR %. %. Today. %. Over 1y. 5 Showing: Purchase, Good (), year fixed, Single family home, Primary residence. While mortgage interest rates have fluctuated in recent months, current year refinance rates remain near the 6% mark, and most homeowners have rates below.